Classic lessons and finance fundamentals inform my approach to investing. Start saving and investing early to crank the flywheel of compounding interest. Minimize costs to keep more of what you earn. Diversify to mitigate risk. Commit to regular and systematic investing, instead of trying to time the market. My Dad introduced this last one to me, years ago, through dollar-cost averaging,

Words inform, and the name of this strategy previews its priorities. “Dollar” means money, as opposed to volume (e.g. numbers of shares). “Cost” is about what we spend (now) as opposed to what we might get later. “Averaging” speaks to doing this over time. In short, dollar-cost averaging is a process that focuses on what we can control.

With dollar-cost averaging, we regularly and systematically invest a fixed dollar amount, regardless the share or fund price or situation in the overall market. When prices are up, we will buy fewer shares, and when the market is down, our allocation pays for more shares. This strategy tends to result in a lower average cost per share over time when compared to lump-sum purchases.

If you participate in a workplace retirement plan with monthly contributions, such as a 401(k), you effectively employ dollar-cost averaging. In addition, users of 401(k) accounts and the like typically trade less frequently in those accounts, further reducing costs and preserving capital. The framework reduces emotion and anxiety while supporting a proactive approach to building wealth.

Dollar-Cost Averaging in Action

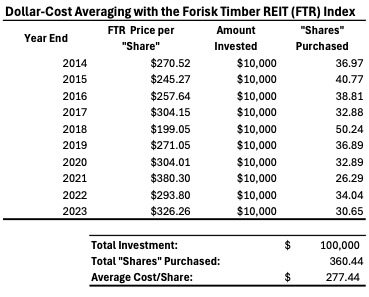

In the timber industry, my research focus at Forisk, the easiest vehicles for applying a dollar-cost averaging strategy are the publicly traded timberland-owning REITs (PotlatchDeltic (PCH); Rayonier (RYN); and Weyerhaeuser (WY)). The Forisk Timber REIT (FTR) Index, commonly called the “footer index,” is a market capitalization weighted index of the public timber REITs.[1] The figure below summarizes a dollar-cost averaging approach to investing in the timber REIT sector based on buying $10,000 worth of FTR Index shares at the end of each year for ten years from 2014 through 2023.

With this strategy, the weighted average cost per “share” is $277.44, while the straight average of the ten year-end prices was $285.21. With dollar-cost averaging, your portfolio has more of the lower-priced shares and fewer of the most expensive shares, which brings down the weighted average. The strategy is not always advantageous. If you had simply purchased $100,000 worth of shares at $270.52 in 2014, you would have been better off. For that reason, it helps to think of dollar-cost averaging as a robust and systematic approach to cost-effectively stay invested over time.

Discussion and Considerations

With the regular, systematic investing of dollar-cost averaging, you acquire more shares when the market is lower, thereby reducing the average per-share price in your portfolio. When the market rises, you acquire fewer share, but you still gain from rising prices because your portfolio already contains shares bought previously at lower prices. In this way, periodically buying fixed dollar amounts outperforms the regular buying of fixed numbers of shares.

Fundamentally, dollar-cost averaging is a risk-averse, conservative approach. While it helps manage risk, it also reduces the likelihood of outsized returns. Dollar-cost averaging functions best in a world where the market always mean reverts. However, the stock market rises, tends to rise, has risen over time, even as it does so on a random path. If the market or asset of choice were guaranteed to increase and appreciate, we’d be better off investing all money now, regardless the prices. But that’s not how life or access to capital work. Most of us save and invest over time as we earn income and generate cash, and dollar-cost averaging serves as an investment hack, a short-cut for the person who wants a reasonable, low cost, relatively effective way to invest systematically without the stress of timing the market.

As a strategy, dollar-cost averaging is also agnostic and indifferent. It will acquire more shares of underperforming firms or funds as easily as attractive and performing investments, so there are still decisions to make. This is one reason why dollar-cost averaging fits well for investing in diversified index funds that tend to follow the overall market.

Conclusion

With dollar-cost averaging, you buy shares of a stock or fund regularly over time at the prevailing prices. With this approach, your average cost is neither the highest nor lowest market price. It is a weighted average that systematically acquires more shares when they are cheaper and fewer when they are dear. This strategy keeps you invested in the market without any need to deliberate over “timing” the market.

[1] Initiated in 2008, the FTR Index provides a benchmark for comparing timber REITs to other timberland investment vehicles and the overall market. To subscribe to the free weekly FTR Index Summary and to obtain historical FTR Index data in an Excel format, please contact Pamela Smith, psmith@forisk.com.

The author offers a sound and most relevant discussion of the dynamics of dollar -cost averaging as an investment strategy. While drawing on the author’s experience in business, the offers some assurance to individuals who participate in government entities such as 401K or private employee-based programs such as TIAA which may practice similar dollar-cost strategies. This is a well written and effective discussion that should be required reading for anyone interested in sound financial practice.